Financial KPIs – How To Detect The Truly Key Ones?

Whether a business is considered a success or not is largely determined by its financial performance which is measured via a number of financial KPIs.

So knowing that, how can we detect which are the truly “Key” indicators, i.e. those Critical Factors or Key Value Drivers that, if they change (for whatever reasons) they produce a chain reaction that leads to a material change in earnings, returns and ultimately the value of the company.

Let me suggest the two ways in which you should look at KPIs, and if you’re still confused, you can look at how Visa measures its key value drivers.

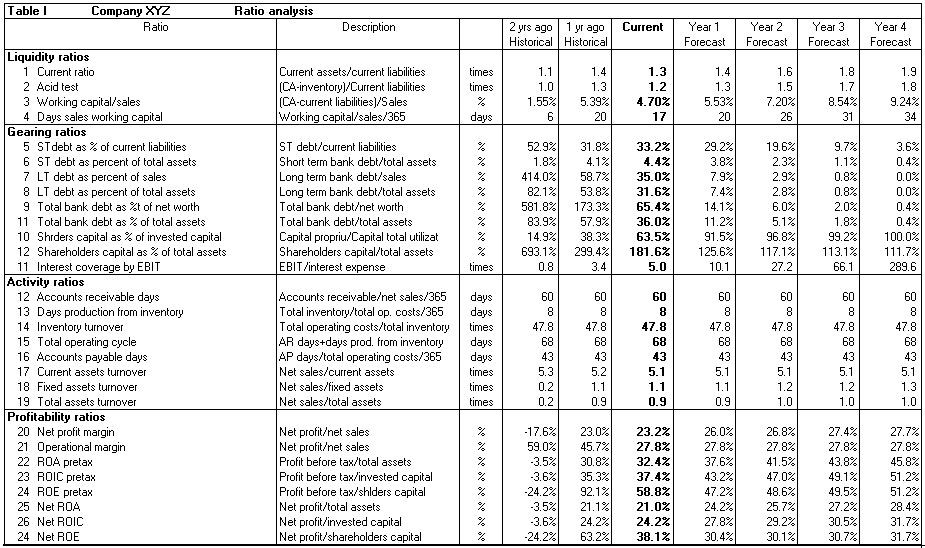

- The “view” of management/owners or stakeholders on whether a business is making money, what is the net profit margin or the leverage, captured in table I – here all these KPIs are analyzed on a historical and forecast basis.

What are the EBITDA margins, operating profit (or EBIT) margin or net profit margin and the top line growth? Cash Conversion Cycle, Working Capital ratio, Current Ratio, etc. As long as the benchmarks are met, management is usually content; this is mostly looking at historical data aka in the “review mirror”.

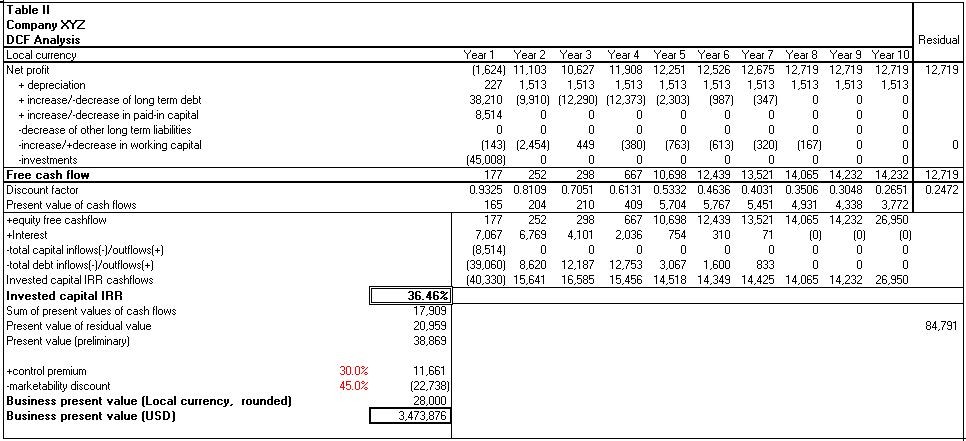

- The investors’ “view” is always forward looking and it questions whether the company is currently undervalued and by how much, ROE, ROI, etc. Table II shows whether the company is under or overvalued.

Which potential triggers, aka KPIs or Key Value Drivers – if they change, could make an impact on the stock price?

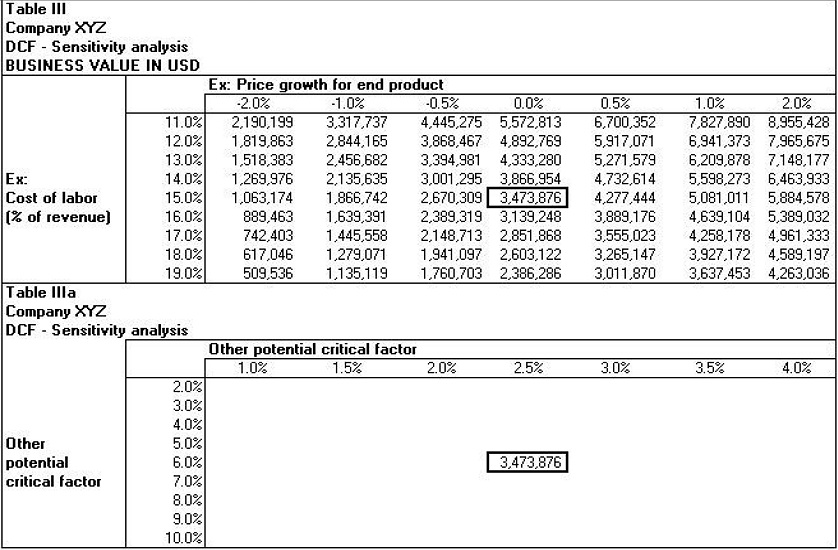

If we look at Table III – through scenarios and sensitivity analysis, one can detect those key factors that are critical to the overall value of the company, i.e. if they change, they produce a material effect on the value.

In Table I, besides the data shown in historical, we can see the current and forecast form. As when driving a car, one does not look in the review mirror but seldom, similarly when analyzing data and trends, one looks in the past to better grasp the capability of the company and be able to forecast. As the road ahead is never as the one behind, other parameters have to be considered for a more accurate forecast.

In financial terminology, Business Intelligence (BI) is using and looking at historical data while Business Analytics (BA) is looking forward. BI is important to improve one’s understanding of business based on past results, while BA tools assist one better understand what might be going to happen.

Through trial and error, using sensitivity analysis (as shown in Table III), one detects the critical factors/key value drivers for a company. Table IIIa, or even IIIb, IIIc and so forth, is shown empty since it could be filled with data that results from the variation of any two other parameters.

Identifying materiality is often a complicated and time-consuming process, but it is imperative for an analyst to narrow down the list of factors to those that may be critical and which are worth monitoring. I suggest that materiality can be identified by common sense and quantified by performing various scenarios and sensitivity analyses.

The analyst should develop an accurate financial model, with a correct interrelation of the elements in worksheets, i.e. inputs, balance sheet items, income statement components, depreciation and investment, debt, working capital assumptions and cash flow. Only by having implemented a reliable financial model can one correctly capture when a slight variation in KPIs produces an impact on company value.

Image sources: