Identifying and Monitoring Financial KPIs (or Critical Factors)

Great (equity research & financial) analysts spend 80% of their allotted research time on analyzing and forecasting only a few of the factors which are likely to impact the value of a company/or “move” their stocks. These factors may go by several names, from Financial KPIs to Critical Factors or Key Financial Metrics.

What makes a factor Critical or Key?

- If it changes even slightly, it could cause material changes in earnings, cash flow and ultimately the value of the company (or the Target Price);

- Materially changes the probability of various scenario(s) happening;

- Changes the volatility profile of the stock;

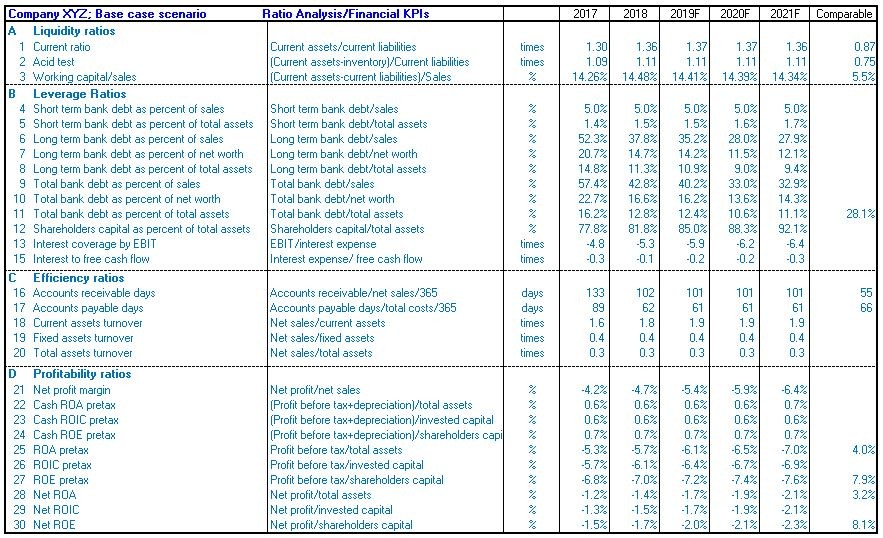

In projects such as business valuation, restructuring or process improvement analysis, an increased attention should be paid to such Critical Factors – example in the table below: doing a historical trend analysis, comparing with ratios of other companies (benchmarks), developing scenarios and/or sensitivity analysis, etc.

These ratios are just one spreadsheet that results from the analysis of future cash flows which itself consists of forecasting the elements of balance sheet, income statement and other (working capital, debt, investment/depreciation, etc).

Besides quantifying the necessary cash flow, this analysis presents the possibility for the company to generate these cash flows internally or to acquire them from the outside.

According to the International Data Corporation (IDC), there will be a fiftyfold increase from 2017 to 2025 in the amount of data needing to be analyzed by companies globally.

If that’s the case, analysts both on the company side (the insiders) and research analysts (the outsiders) should focus entirely on the key Finance KPIs (insiders) and Critical Factors (outsiders). Chasing too much data would result in a muda of over-processing.

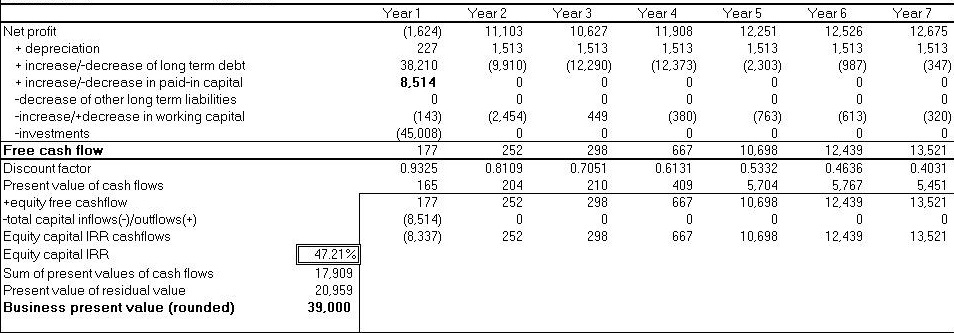

Ultimately, the question is whether the company is a good investment or whether the company (or project) creates value or not. Is it value created by this company or value destroyed? What is the Internal Rate of Return (IRR) for the particular investment?

The answer should be apparent from such an analysis. For instance, a company’s equity value is readily apparent (and one can determine a price per share, and decide whether it’s worth investing or not).

However, whether a company (or a project) creates value is apparent only if the IRR is sufficiently higher than the discount rate derived through – in this case – CAPM (Capital Asset Pricing Model) or WACC.

Image sources:

Tags: Data analysis, Finance performance, KPI