Building Blocks for Launching a Successful Business

Image Source: Adeolu Eletu | Unsplash

Startups have become the lifeblood of many nations and the cornerstone of many economies. In fact, startups are a source of new jobs across the globe and bring the markets new innovative ideas and solutions. Moreover, they boost competition in markets by developing new and similar products which benefit the consumers. Despite the increasing trend of self-employment in many countries, many fail to stay in business as it is not an easy process to develop a successful one. Consequently, this article aims to give a brief of the key building blocks for starting a successful business.

- Self-Assessment

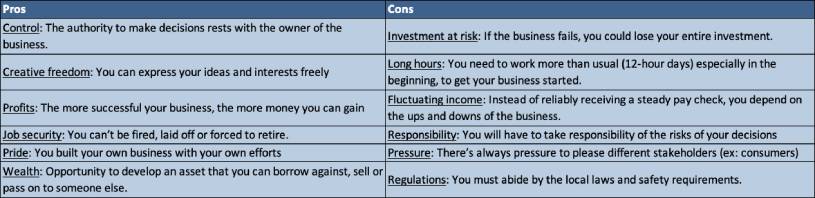

The first thing an entrepreneur should start with is self-assessment. Before launching your business, you need to realize whether you have what is needed for your business. Start by listing the advantages and disadvantages of having your own business. And you need to compare between being an entrepreneur and full-time/part-time employed (in case this is your current situation) given your current circumstances (ie. marital status, financial situation). There are a lot of personality tests that could help you in assessing and knowing yourself. Answering the below questions accurately and honestly may help in making your decision:

– Why do I want to launch a business?

– Specifically, what type of business do I want to launch?

– Why do I believe I can make this kind of business work?

– Why do I believe this kind of business is sustainable?

– Do I have the needed educational level, skills, and experience to succeed in this field? If not, can I attain these skills and competencies before starting my business? How?

– What is my true aim and/or the objective I hope to attain with this business?

– What is the financial objective I am pursuing to attain?

– If I will need financing, do I have enough resources and credit for the startup?

– What are my strengths and weaknesses?

– What is the state of my physical, mental and emotional health, and stamina?

– Do I have the required skills and knowledge to manage the daily operations of a business?

– Am I up to date with the latest technology necessary to be competitive in this industry?

– What sacrifices and risks am I willing to take to be successful?

– Will I be able to maintain a work-life balance? How?

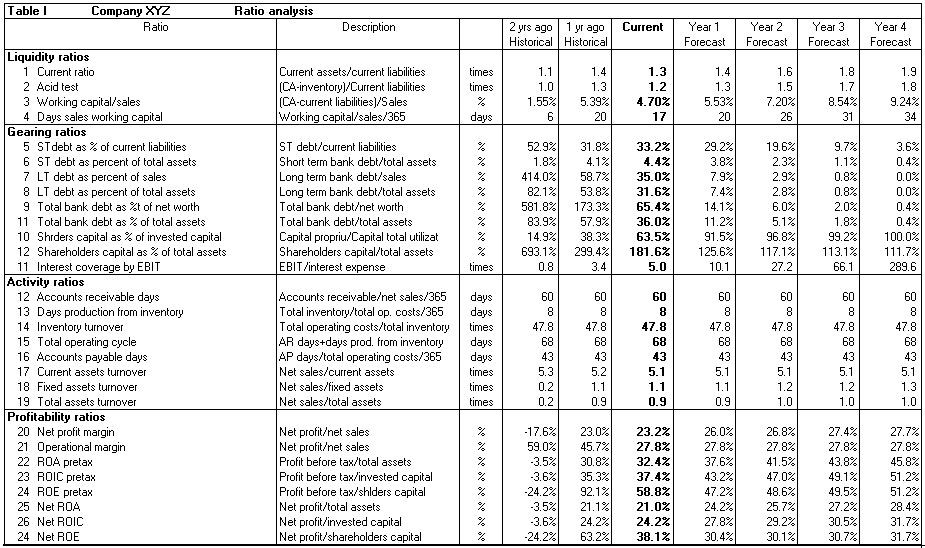

Figure 1 below shows some advantages and disadvantages that you could consider as suggested by Gregory and Patricia Kishel in their 2005 study, How to start, run and stay in business:

Figure 1: Source: ResearchGate

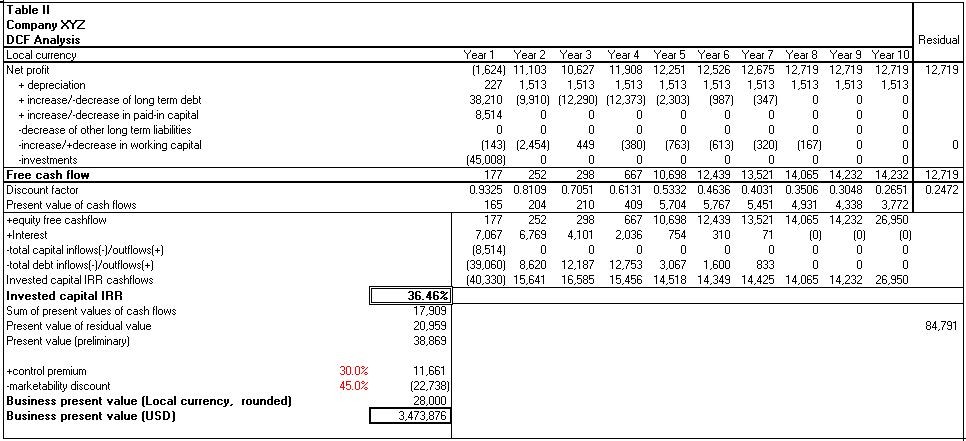

- Market Understanding

This stage does not refer to extensive market research but rather to the start of exploring the industry/market in which you want to launch your business, especially if you don’t have a clear and solid business idea. This phase suggests networking and connecting with different people or stakeholders to have a clear view of how things are going in the industry. At the same time, this will give you a chance to build on your current network as well as gain tips and recommendations for getting your business started. This could be done through several means such as scheduling meetings with owners in the same field or attending conferences and events.

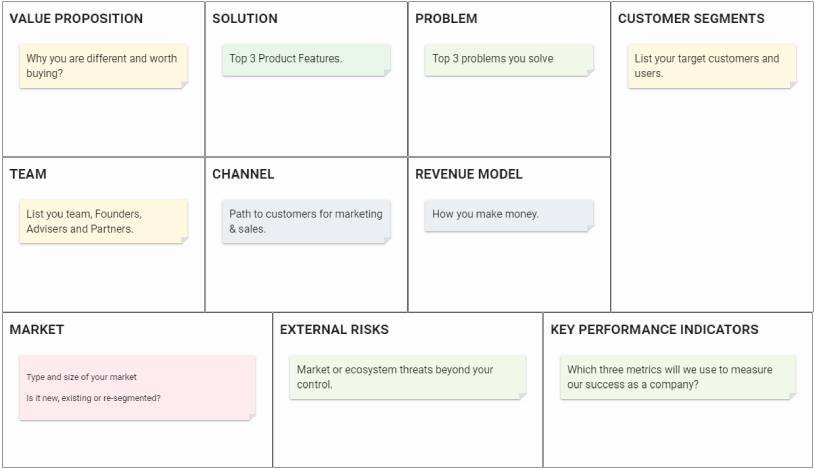

- The Start-up Canvas

This canvas is one of the techniques that entrepreneurs could use to sketch their initial ideas for their business idea. The start-up canvas includes the components shown below.

Figure 2: Source: Upmetrics

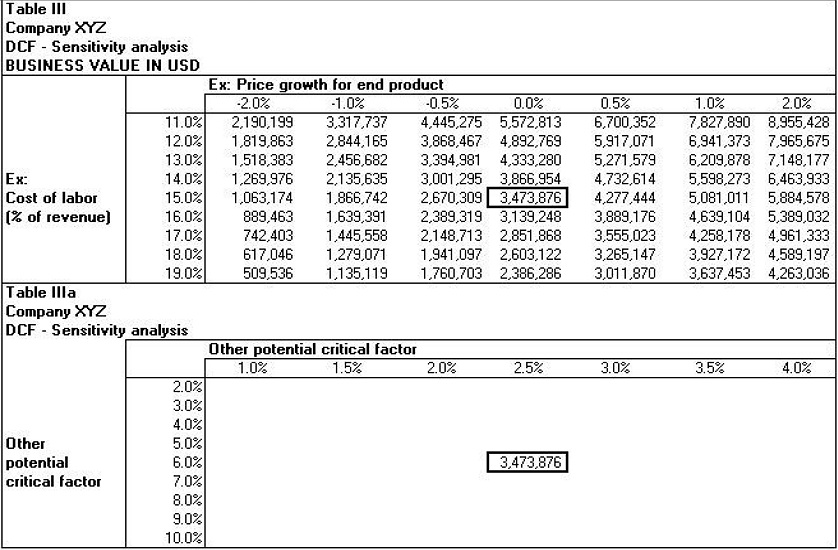

- Extensive Market Research

When you reach this stage, it means that you have decided to go on with your business and do more extensive research to better understand your business. There are two types of research: secondary or desk research, and primary research.

You might want to start first by doing desk research and checking documents such as reports, articles, and press releases to give you some insights into your industry. Then, you can conduct a market research study or focus group to get more specific insights from the market. In this case, you can consult a market research agency to conduct the study.

In Figure 3 below, Michigan Small Business Development Center suggests a checklist of market research information:

Figure 3: Source: Michigan Small Business Development Center

- Cost/Financial Analysis

This part is concerned with estimating your costs to launch your business. According to the Michigan Small Business Development Center, the following contribute to the reason as to why many startups fail before they launch their business or soon after launching it:

– An inadequate estimate of the real cost of starting what you are planning to

– Unrealistic anticipation about resources you might hit into; grants, tax incentives, and startup loans are uncommon, competitive, and difficult to acquire

– Miscalculations about how quickly you will start making money; for instance, some businesses may take a few years to start making a profit, so you need to make sure that you will be able to cover your company costs during those years.

Consequently, it is necessary to consider some of the financial analysis tools which many entrepreneurs miss, such as the payback period (refers to the amount of time it takes to recover the cost of investment), internal rate of return, cash flow, profit margin, gross margin, and markup and breakeven analysis. These techniques will permit entrepreneurs to plan their financials ahead of launching their business and avoid financial failure.

- Sources of Finance

In this phase, you will have to consider the means for financing your business. There are several sources of finance such as your personal investment (ie. your own money and assets), bank loans, venture capital, business incubators, angels, or grants. You need to take into consideration several factors when deciding on the sources of finance, such as the nature of your business and business size. Some entrepreneurs may decide to continue their full-time/part-time job and work on their businesses slowly to finance themselves while launching their businesses.

- Human Resources

This stage helps you to estimate how many employees you need to hire when you launch your business. Which departments do you need to start with? You do not want to hire less or more than what you need. Moreover, you need to consider several factors before hiring your employees, such as the employment labor law, taxes and social insurance exempted from employees’ salaries, and health and safety measures.

- Business Plan

The previous stages will allow you to have enough data to conduct an accurate business plan which describes the objectives and goals of your business. This also studies your business idea from financial, operational, and marketing perspectives. In your business plan, you have to fill in the following components: general business information, market analysis (competitive analysis, industry analysis, segmentation analysis, marketing/sales plan), management and operations matters (human resources, operations plan, research, and development plan), cost structure, and financials.

- Legal Formation of a Business

When deciding to launch your business, it is important to know the procedures and regulations to legally form your business. First, you need to choose the type of business you are going for. This is based on the country you are establishing your startup in. Based on this, you will be able to identify your tax implications and company registration procedures. It is advisable to do this with a specialized lawyer to guide you through the process.

In conclusion, launching your business is a hectic and risky process that you need to think of very carefully. Take your time whenever you work on any of the building blocks and decide whether you are capable of moving on to the next stage or not. Remember you do not have to start big; you can start small and expand over time. Several startups have started small and now they are some of the most successful startups such as Khan Academy, Udemy, and Slack.