Insights on Developing a Bank’s Balanced Scorecard

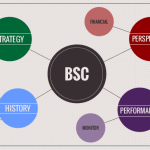

Managing performance by using the Balanced Scorecard (BSC) concept assists banks in appreciating whether their growth strategies are successful or not, and what new initiatives are required to achieve their strategic objectives in the future.

1. The “Financial” perspective of a bank’s BSC can be structured around two main strategic objectives: reducing operating expenditure and increasing profit margin.

Nowadays, banks are very concerned with reducing operating costs, while focusing on technological advancements. Diversifying the end uses of internet banking and ATM machines are lead actions in increasing the efficiency ratio and reducing overall operating expenses.

A bank’s % Capital adequacy ratio (CAR), % Portfolio yield and % Risk coverage ratio can be used as lead key performance indicators (KPIs) of the increase in financial performance. Due to external factors, there is a constant issue with borrowers defaulting on rates.

Capital adequacy ratio ensures that the bank has the necessary capital to back up the risk weighted credit exposures. This KPI is closely related to the portfolio yield, which ensures that enough income is generated through the lending process. The risk coverage ratio ensures that there are enough provisions to cover eventual losses generated by non-paying borrowers.

2. The “Customer” perspective of a bank’s BSC can include a number of strategic objectives related to service quality, product delivery and customer loyalty, as well as back office support optimization and customer line resolution rate.

In regard to service quality, there are two KPIs that banks should necessarily focus on, namely % Customer satisfaction with service levels and % Customer satisfaction with new products and services. This insight on customer perspective helps the bank decide whether the services they offer still meet the requirements of the market and if the new products and services have competitive edge.

Product delivery ensures that the products and services of the bank are up to date, which leads to a high interest from customers who will, consequently, continue to use them. Keeping customers active is one of the main concerns that banks have nowadays.

An inactive portfolio causes financial loss for a bank. In a fast paced business environment, it is of utmost importance that bank interactions with its customers are mainly facilitated through electronic service delivery, such as the bank’s website, internet banking and multi-functional ATMs.

The customer’s line is a very important part of a bank’s operational system. A bank’s support line for customers is more than having to deal with complaints.

Customer support lines are the liaison between customers and all other departments of the bank, they are a tool to gain insights on customer needs, a means of solving problems at a fast pace, a provider of transactional information that would otherwise be overlooked, a customer problem detector and solver.

3.The “Internal Processes” perspective of a BSC can be designed around core strategic objectives related to market share, brand recognition and product competitiveness, front office and infrastructure management system operability.

% Market share is an important KPI of the banking industry. Banks look at market share from many perspectives. One is the individuals market share, the second is the small and medium enterprises one and the third is the corporate enterprises market share.

A bank’s success depends on coherently distinguishing between the three. Customer acquisition is crucial for all three segments of the market share, but it is imperative that a bank defined where customer acquisition – in terms of generated revenue – is most necessary.

Brand recognition is what a bank needs in order to be visible to customers. Powerful marketing campaigns ensure brand penetration and eventually brand dominance on the market. Brand dominance is what keeps customers on choosing the same bank over and over again.

The true interest cost is the first thing customers compare when trying to decide whether they want to borrow from one bank or the other. The lower the true interest cost, the more customers are interested in borrowing. Lower interest costs mean lower rates.

In order to provide low interest costs to customers, a bank has to ensure it has interest cover, which means that it has to decide whether its profits can cover the interest cost on debt.

Low interests and good exchange rates go hand in hand when it comes to a bank’s success in attracting more customers. Exchange rates are especially important to small, medium and corporate enterprises, when they consider a bank’s services.

Currency risk exposure is the first thing to be taken into consideration when a bank decides on the exchange rates it wants to practice. Loans are an important part of a bank’s strategy. Banks are interested in lending long term, most frequently in the form of mortgages, in order to achieve high interest rates.

The productivity of the loan officer is an important KPI for front office operations, but the value of the portfolio per loan officer must also be taken into consideration. The value of the portfolio has two dimensions: the “money” value and the “quality” value. It is not only necessary that loan officers lend lots of money, but it is also crucial that they lend out to reliable people, people who can honor their financial commitments.

4. A bank’s “Learning & Growth” perspective should ensure payroll accuracy, increase staff loyalty and ensure personnel security.

In order for a bank to keep its employees, it has to make sure that it has the necessary funds to pay them. On the other hand, bonus payout is a very important part of front line employee compensation in a bank. In order for a loan officer to exceed his/her targets, for example, he needs to be motivated.

As much as a bank wants its front office employees to exceed their targets, it should also make sure that it can deliver adequate bonuses for over-achievements. In order to achieve a high efficiency ratio, some banks rely on bonuses, while offering small wages, in order to motivate people to exceed their targets and earn more money.

The security aspect is crucial in the banking industry, especially with bank tellers or other procedures that entail cash transactions and depositing. Having social insurance coverage may be a deciding factor recruitment processes for these kind of jobs.

Image Source:

Tags: Balanced Scorecard, Banking performance, Performance Management