How to Use Value Flow Analysis to Link Processes to Strategic Objectives

Image Source: Pixabay | Pexels

The term value flow analysis is derived from the concept of value stream mapping, which is deeply rooted in activities relating to producing and delivering a product or a service to the customer. James Womack, Daniel Jones, and Daniel Roos first formulated the value stream concept in their book entitled ‘The Machine that Changed the World”. Published in 1990, the book was considered to have launched the Lean movement, which popularized methods of systematic reduction of waste in working processes.

James Womack and Daniel Jones further took on the concept in their book entitled “Lean Thinking,” published in 1996. It defines a value stream as “the set of all specific actions required to bring a product or service through critical management tasks.” (Womak & Jones, 1996, p. 19) According to Drew Locher, the author of “Value Stream Mapping for Lean Development,” “Value stream mapping is an effective and proven tool to assess existing business processes and to re-design them based on <Lean> concepts.” (Locher, 2008, p. 1)

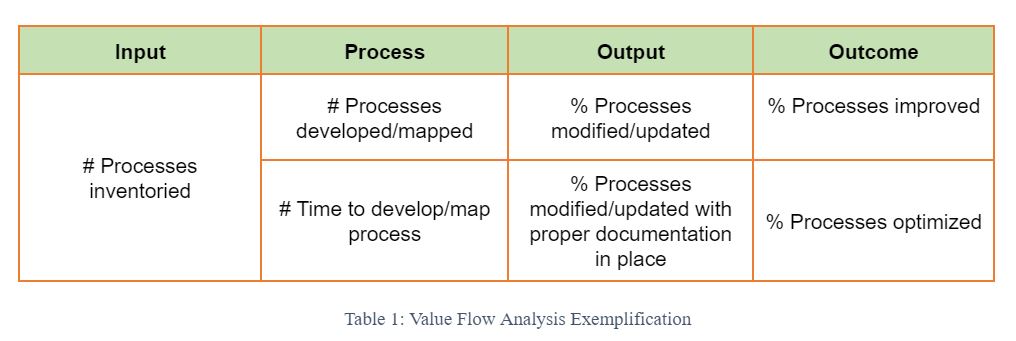

As related to process performance and a potential model for linking processes to organizational strategy, value flow analysis enables the categorization of KPIs through their contribution to the main stages in the value generation chain: input, process, output, and outcome. Furthermore, this distinction allows for a deeper understanding of each KPI’s contribution to the organizational objectives set, based on clear assignation to the following listing:

Input metrics are associated with the quantity or quality of the resources engaged in a particular task or operational activity. Such metrics or KPIs will be generally linked to budgets, human capital, and other tangible assets the organization brings to the production/development process. Input metrics will generally be related to achieving financial objectives, such as maintaining the company’s financial discipline, internal processes objectives like the efficient use of company resources, or people-related objectives, such as the availability of human resources for the organization.

Process metrics are affiliated with the transformation process that is involved with taking the company’s inputs and converting them into desired outputs for the organization. Process metrics commonly reflect on the activities or actions that are taken to convert inputs into organizational outputs. Process metrics will reflect on the achievement of internal processes objectives as a rule. Quality and time-based considerations will be best reflected with selecting and establishing process metrics or KPIs for the organization.

Output metrics are indicative of the results obtained with the designated inputs of the organization. Output metrics or KPIs will commonly reflect on a backward or reversed control representation of the efficiency with which the company’s resources or inputs are used to produce final products or develop end-user services.

Outcome metrics reflect the ultimate effect on the value of the organization’s production and service development processes. Outcome metrics or KPIs will frequently support top-level objectives while reinforcing the company’s overarching purpose as reflected in its strategic themes. Although not generally used with the more common Value Stream Mapping technique, outcome metrics are desirable because they allow for a more valid association with organizational objectives by organizational layers.

Documenting processes by use of the value flow analysis serves multiple purposes. The quality of process outputs and outcomes is directly related to the quantifiable amount of inputs, efficiency, and speed with which they are used in the process of their transformation. As quantifiable measures of a company’s operational performance, KPIs are therefore an effective instrument for decomposing processes by their main value creation stages:

Quantitative KPIs will stand for the measurable characteristics of the inputs that go into the value creation chain. Quantitative KPIs easily relate to an objective appreciation of the amount of inputs or resources the company uses to obtain its desired outputs and positively influence envisioned outcomes.

Time-related KPIs will be easily identifiable with the activities or actions that are undertaken as part of a process. Time-related KPIs will always be process-based, given that they are the only ones capable of accurately reflecting on the speed of the transformation process.

Qualitative KPIs will relate mainly to the outputs and outcomes in the company’s value creation chain while reflecting on the quality of results produced as part of the transformation process. Qualitative measures are still quantitative; however, they possess the additional capacity of reflecting on the quality of operations conducted.

These particular characteristics make KPIs easily responsive to the four stages in the value creation process and are also similar to the characteristics of organizational objectives, which are either quantitative (i.e., Reduce operating costs) or qualitative (i.e., Improve service quality). This, in turn, makes it easy for an organization to assign KPIs to desired business objectives in a concentrated effort of monitoring the high-level strategies or the company’s follow-through on its strategic themes.

If you would like to learn more about KPIs, sign up for The KPI Institute’s Certified Professional and Practitioner course today.