Measuring Corporate Sustainability Using the ROSI™ Framework and % ROI

Image Source: Gino Crescoli | Pixabay

Corporate sustainability (CS) represents a business approach that creates long-term shareholder value by embracing opportunities and managing risks derived from economic, environmental, and social developments, Yale University states. Organizations are increasingly realizing that their long-term success and profitability depend on measuring the financial impact of CS initiatives for several reasons: enhanced risk management, increased cost efficiency, greater investor demand, and improved brand reputation—ideas that were highlighted in a 2022 paper from the International Journal of Economics and Management.

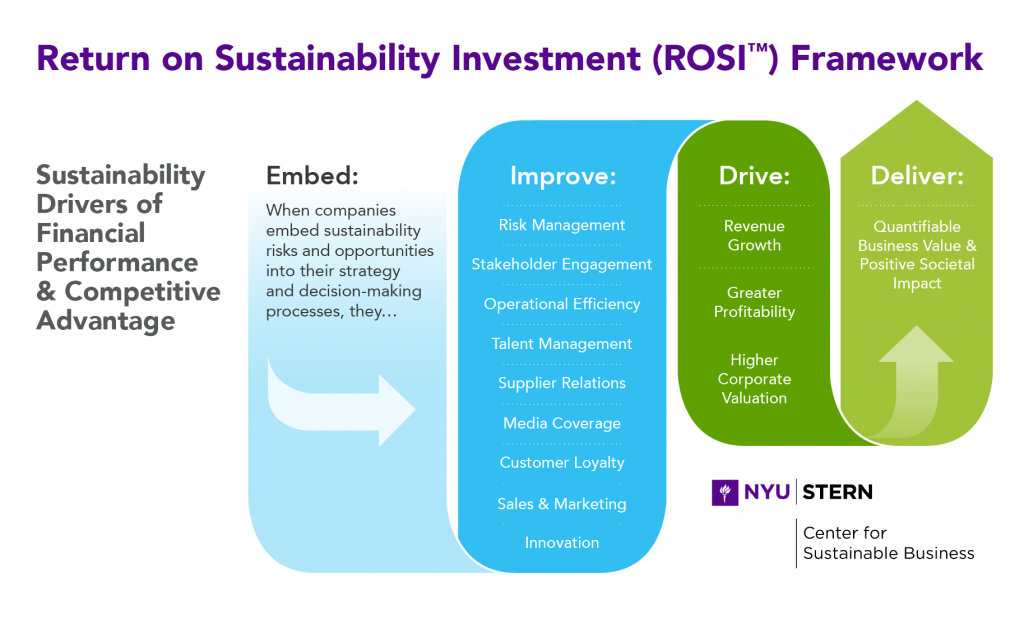

The NYU Stern Center for Sustainable Business developed the Return on Sustainable Investment (ROSI™) framework as a methodology used to evaluate the financial performance and returns generated from sustainability initiatives. It aims to measure the economic benefits derived from sustainability investments and assess the value created for the organization.

ROSI™ assists decision-making processes, resource allocation, and the prioritization of sustainability investments based on their potential financial returns. The framework also facilitates communication with stakeholders (i.e. investors, customers, and employees) by quantifying the financial value created through sustainable practices. The sustainability drivers of financial performance and competitive advantage based on ROSI™ methodology can be consulted below (see Figure 1).

Figure 1. The ROSI™ Framework | Source: NYU Stern Center for Sustainable Business

Entities need to follow a clear set of steps to implement the ROSI™ methodology, per The NYU Stern Center for Sustainable Business:

- Identify material sustainability practices.

- Determine the potential benefits that might drive financial and societal value from sustainability-focused practices.

- Quantify benefits derived from the sustainability practices.

- Derive a monetary value for the benefits.

The main advantage that ROSI™ brings is helping companies make a compelling business case for sustainability, driving both financial value and positive societal impact while advancing sustainability goals, as NYU Stern concludes in a report published in 2021.

Read More >> Why Sustainability Is an Important Component of an Organization’s Strategy

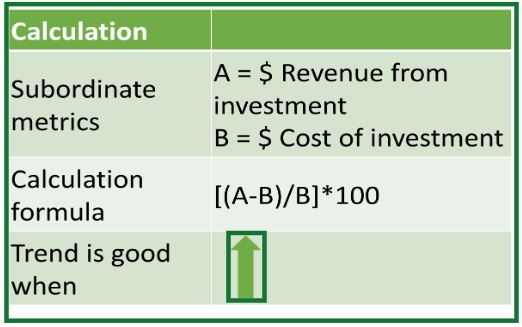

HSBC Bank USA and the NYU Stern Center have launched the Food and Agriculture Sustainability Strategies Framework, based on ROSI™ to help food and agriculture companies make a business case for sustainable initiatives that deliver financial value and societal impact. The framework identifies twelve sustainable strategies and describes practical suggestions for calculating returns. It serves as a strategic tool for unlocking the advantages of sustainability and driving real change in the industry.According to Forbes—and adapted to adhere to The KPI Institute’s KPI naming standards—% Return on investment (% ROI) is a KPI that measures the efficiency or profitability of an investment or compares the efficiency of several different investments. This metric is also used to measure and evaluate the financial impact of organizational sustainability initiatives, making it easier to understand the value proposition of certain environmental, social, and governance (ESG) criteria used in socially responsible investing. A positive % ROI score indicates a profitable outcome, as the gains generated from the investment exceed the costs incurred (see Figure 2).

Figure 2. ROI KPI calculation | Source: Adapted from smartKPIs.com

An article from Brightest presented findings based on data gathered between 2020 – 2023 from five top companies that measure the ROI of sustainability. It stated that companies like HP Inc. ($3.5B), Unilever ($1.2B), McKesson ($227M), Nike ($50M), Anheuser-Busch ($7.5M), and Medtronic ($2.2M) earned extensive profit from internal cost savings actions based on sustainability criteria like energy efficiency or waste reducing. By demonstrating the financial value of sustainable practices, % ROI enhances the business case for social investment and encourages stronger ESG administration, balancing monetary performance with social and environmental impact.

ROSI™ and % ROI are valuable tools for measuring the financial impact of sustainability initiatives. ROSI™ goes beyond traditional metrics, helping companies understand the value of sustainability strategies. Meanwhile, % ROI quantifies the fiscal returns generated, enabling data-driven decision-making. Together, they support making informed choices, practicing accountability, and leaving behind a positive environmental and societal impact while delivering long-term financial value.

**********

Editor’s Note: This article was originally published on August 14, 2023 and last updated on September 17, 2024.