The Qatar National Bank: Strategizing for Performance through KPIs

After the financial crisis that began in 2008, banks have been taking steps to improve their performance management and measurement capabilities in light of new economic and market conditions and new management needs.

Banks are trying to manage costs better, deepen relationships with customers and enhance product mix and pricing decisions. These and other factors are causing banks to re-examine and improve the ways in which they measure and report business performance.

Performance Management in the Banking Industry

Bank performance management has been a hot topic in recent times. With increasing pressure from federal regulations and the downturn in the economy, financial institutions have been searching for new and innovative approaches to improve their bottom-lines.

In this regard, some major areas of emphasis and trends which are emerging across the industry are as follows:

- Reviewing and enhancing organizational management profitability-reporting methodologies;

- Emphasizing the use of business-unit key performance indicators (KPIs);

- Refining customer- and channel-profitability measurement and analytics;

- Improving the alignment of the performance management process’ components;

- Improving systems support and the automation of the performance management process;

- Improving data quality and consistency.

In some of the world’s largest banks, monthly organizational profitability reporting is sophisticated and well-accepted. However, bank executives are looking for measures that will assist them in understanding potential future performance, as well as in analyzing historical financial performance.

The use of enterprise and specific business KPIs in management reporting is growing. Banks are determined to see which KPIs will allow them to gain insights into the enterprise’s underlying performance beyond a purely financial view.

Reporting on KPIs that truly drive value provides more information upon which to make decisions and engage in strategic discussions about the business. Each bank has its own KPI selection process. KPIs are appropriate to the specific needs of each entity, being based on its strategy and the general vision.

For the most part, some of the more common KPIs practiced by the banking industry include the following: # New accounts opened, # Account attrition, % Balance growth, # Products per customer, # Delinquencies, % Net promoter score, # Headcount.

The Qatar National Bank: A Case Study

Today, the Qatar National Bank is one of the leading banks in Qatar. This company has both public and private organizations as its stakeholders, hence 50% of the Qatar National Bank is owned by the government, while the rest of the bank’s shares are owned by the Qatari public.

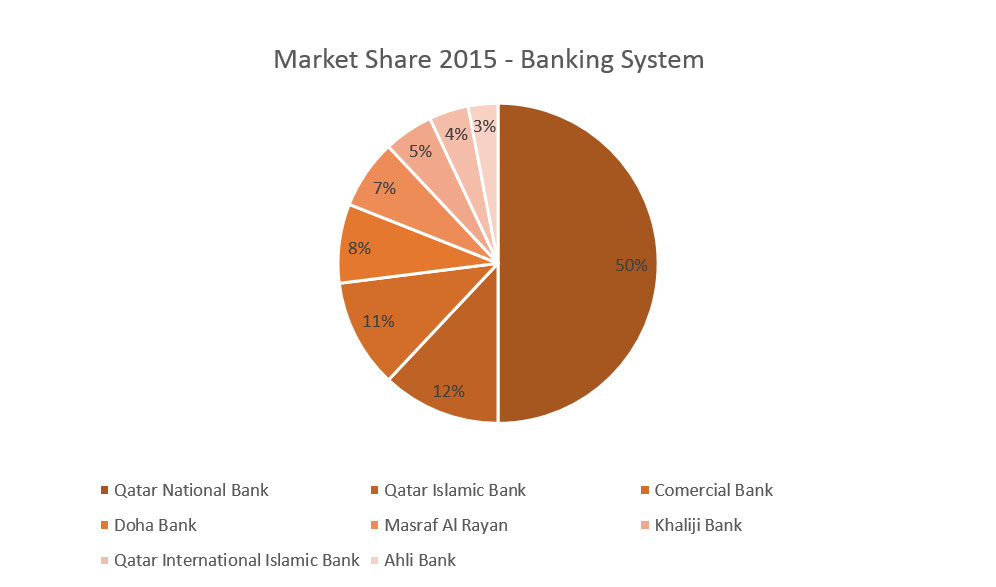

When analyzing Qatar’s banking sector, it can be easily noticed that it’s a rather restrictive market. This is due the fact that the National Bank has more than 50% out of the total market share.

The National Bank of Qatar is well known for developing and implementing an efficient performance management system. The adoption and usage of these tools have ensured the company’s rapid development. The whole system used by National Bank of Qatar was constructed in perfect alignment with the bank’s strategy and market fluctuations.

Hence, they have introduced internal changes to improve the quality of their services and, furthermore, they have also diversified their services. The latest internal changes that have taken place aim at improving its efficiency and maximizing return on equity.

At the same time, as the bank is to meet the expectations of its customers, it has decided to bring focus to and work on their customers’ loyalty. The latter is of paramount importance in the contemporary business environment, especially when the competition in the financial industry has increased dramatically.

In this context, the National Bank’s focus on rebranding is quite logical. In fact, the bank has attempted to change its logo, as a first small step of refreshing its public image. The ultimate goal of all these changes and rebranding is adapting the bank’s image to today’s ever shifting business environment.

Another important aspect of its strategy is the fact that the bank has been engaging additional staff and highly qualified professionals. This strategy is very important because Human Resources constitute a strategically important part of the bank’s assets. In addition to this, the involvement of well-qualified specialists will improve the bank’s competitive position.

Finally, the Qatar National Bank pays particular attention to its young clients, which are strategically important for the bank and are viewed as one of the major target customer groups. Every objective stated in the strategy is reported monthly, in order to track progress and to ensure that all the goals will be met in time.

Even though the KPIs used by the National Bank of Qatar are not available for the public, some KPIs which can be used in this situation are the following: # New young clients, % New client’s satisfaction, # Employees meeting the desired level of skills, % Employees turnover, % Retention rate.

Taking into consideration the information presented in this article, it is quite clear that every financial institution should look to readapt their strategy, and their way of collecting & reporting data, in order to make sure that they will survive in a continuously changing market and satisfy an increasingly wide array of customers.

Image sources:

Tags: Banking performance, Government performance, KPI, Performance in Qatar